Editor of payments and treasury management software

Exalog is a family-owned business that builds trust and long-term relationships with its clients

Exalog joins Cegid

Cegid confirms acquisition of Exalog, a specialized editor of treasury management software in SaaS mode. Cegid thereby strengthens its offering in treasury, ERP and tax, providing a complete financial suite to meet the needs of Finance departments, from SMEs to key accounts

Our solutions

![]()

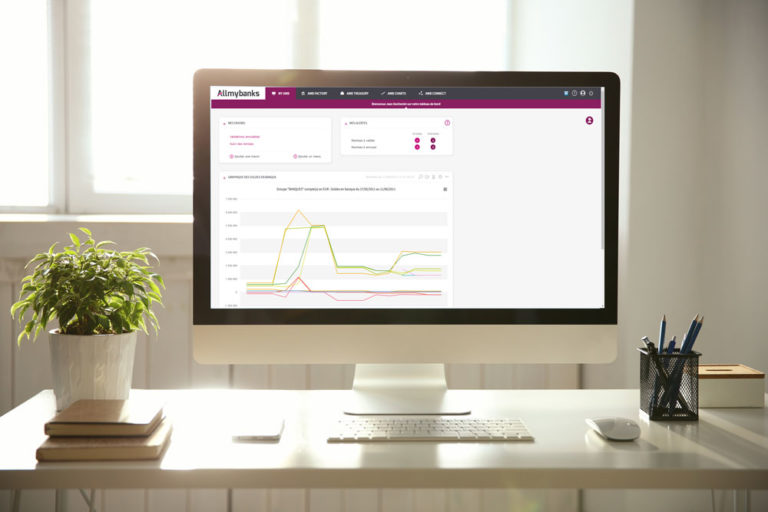

Paiements internationaux et trésorerie groupe

Solution certifiée par SWIFT, Allmybanks permet aux groupes de gérer leurs flux bancaires et d’optimiser leur trésorerie au sein d’une interface sécurisée : connexion au réseau SWIFTNet via Alliance Lite2 for Business Applications, gestion intragroupe, workflow de validation des paiements...

Flux multi-bancaires et trésorerie dans la zone SEPA

Exabanque est une solution de gestion multi-bancaire et de trésorerie adaptée aux PME. Le logiciel propose le protocole EBICS pour les échanges bancaires et des fonctionnalités avancées de trésorerie, rapprochement bancaire et automatisation des flux (ERP et comptabilité).

Découvrir Exabanque

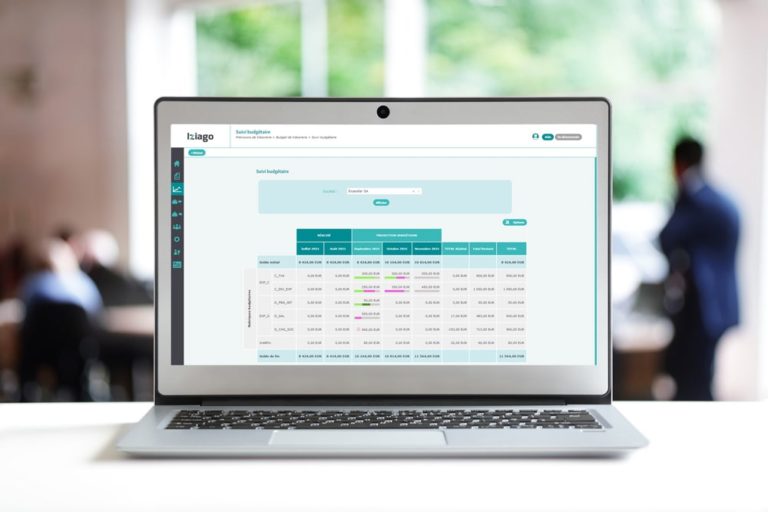

Solution complète de cash management pour les PME et TPE

Iziago propose aux PME une gestion complète de leur cash management grâce à sa solution modulaire : paiements et prélèvements SEPA et ISO 20022, prévisions et budgets de trésorerie, centralisation automatique des relevés bancaires, etc.

Découvrir Iziago

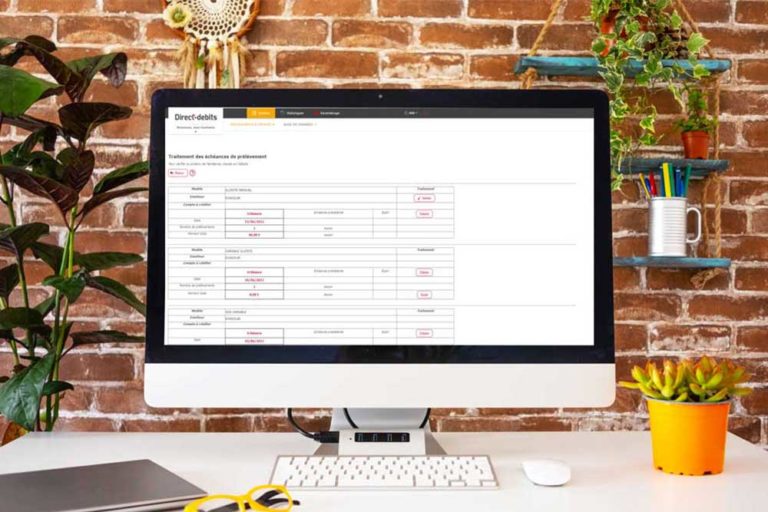

Gestion des prélèvements et mandats SEPA

Avec Direct-debits, vous gérez vos prélèvements et vos mandats au format SEPA : génération automatique des ordres, administration des échéanciers par abonné, création et stockage des mandats (électroniques), suivi et traitement simplifié des impayés, etc.

Découvrir Direct-debits

Solution multi-bancaire commercialisée par des distributeurs

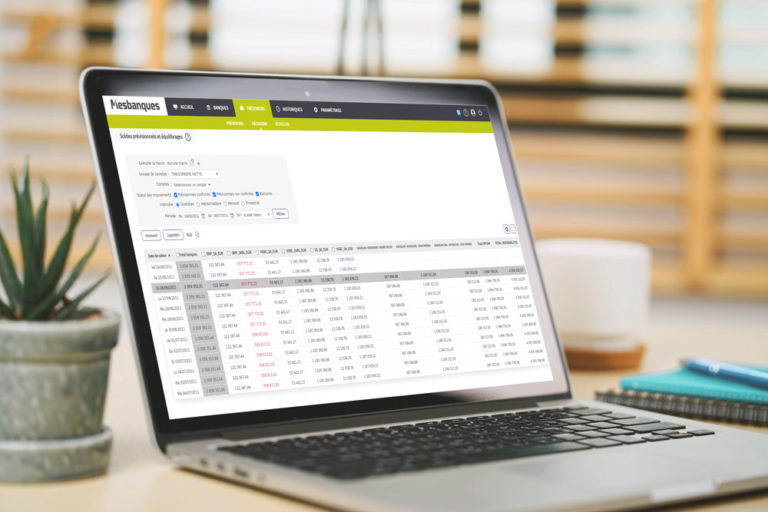

Mesbanques est un logiciel web de gestion multi-bancaire commercialisé par un réseau de distributeurs en France et en Europe : communication bancaire en EBICS, trésorerie, rapprochement comptable, connexion avec des logiciels de gestion internes, etc.

Découvrir Mesbanques

Why choose us?

Transparency

Clear well-known rates in advance and transparent contract

Transparency

Security

ISO 27001 & 22301 certified hosting and security updates

Support

Unlimited, cost-free, multilingual support to assist you

Banking communication

Multi-protocol connectivity (EBICS, SWIFTNet, FTPS, PeSIT)

Independence of banks

No commitment or obligation towards banks

Experience

More than 35 years of experience in the exchange of financial flows

Our certifications

Exalog certified ISAE 3402, SWIFT, and ISO 27001: a pledge of trust and security

At Exalog, we value security and transparency. Our software Allmybanks has received its ISAE 3402 report, ensuring high-level internal controls and risk management. As a provider connected to the SWIFTNet network, we also meet the strict security standards of SWIFT, ensuring unmatched reliability. Moreover, our ISO 27001 certification underscores our ongoing commitment to information security management.

Nos clients témoignent

News

Cegid confirms acquisition of Exalog

Press Release Cegid confirms acquisition of Exalog Cegid, a European leader in cloud-based management solutions for professionals in finance (ERP, treasury, tax), human resources (payroll,

Exalog is ISO 27001 certified!

We are proud to announce that Exalog is certified to ISO 27001, the standard of excellence for information security management.

AFTE Days 2023

The AFTE days are the must-attend event for treasurers! And, as every year, the Exalog teams will be present at the Palais Brongniart in Paris