What is SEPA?

SEPA: European standard for payments

SEPA is the Single European Payment Area, in euros.

Within this zone, which brings together 37 countries including the 28 members of the EU, the means of payment are harmonised to:

- Simplify payments management

- Reduce processing periods and costs

SEPA Credit transfers - SCT

The SEPA Credit Transfer (SCT) is a payment transaction in euros between two bank accounts in the SEPA area.

It is characterised by:

- An execution time of 1 business day

- BIC / IBAN codes allowing the identification of the account and the bank of the recipient

- A 140-character label

SEPA Direct Debit - SDD

SEPA Direct Debit (SDD) is a means of payment in euros that allows a creditor to withdraw a debtor's account within the SEPA area.

Its implementation by the creditor requires:

- A SEPA Creditor Identifier (SCI), provided by its bank

- A mandate signed by the debtor (direct debit authorisation)

- BIC / IBAN codes to identify the debtor’s account

- The sending of a notification by the creditor before the 1st debit (direct debit notice)

- Creation of a direct debit order by the creditor, 2 to 5 days before the date of payment

ISO 20022 format

SEPA credit transfer and direct debit files must comply with the ISO 20022 XML format.

This file standard was adopted in the early 2000s by banks around the world to exchange data with each other and with businesses.

Thanks to this international harmonization, sending SEPA payments and direct debits as well as exchanging information (account statements, direct debit changes, investment and financing management, cash flow, etc.) is faster and easier.

SEPA and Exalog's software

Whether it is SEPA credit transfers or direct debits, whose files must comply with the ISO 20022 XML format,

you have the possibility to perform these operations through our software:

![]()

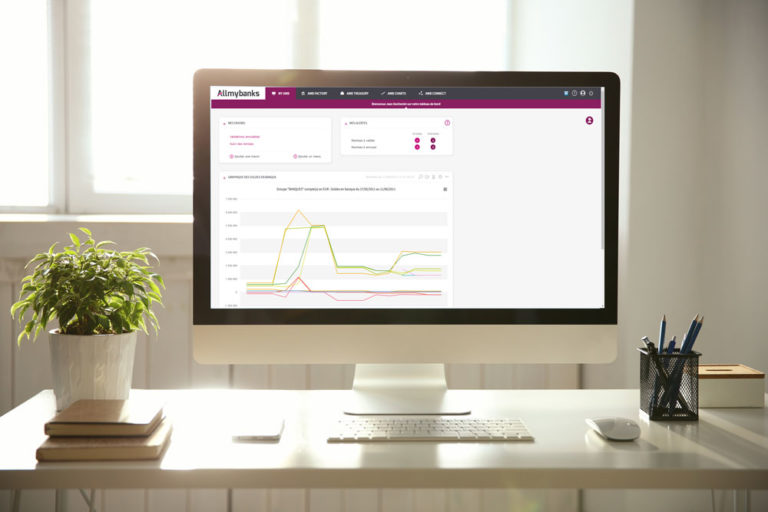

Paiements internationaux et trésorerie groupe

Solution certifiée par SWIFT, Allmybanks permet aux groupes de gérer leurs flux bancaires et d’optimiser leur trésorerie au sein d’une interface sécurisée : connexion au réseau SWIFTNet via Alliance Lite2 for Business Applications, gestion intragroupe, workflow de validation des paiements...

Flux multi-bancaires et trésorerie dans la zone SEPA

Exabanque est une solution de gestion multi-bancaire et de trésorerie adaptée aux PME. Le logiciel propose le protocole EBICS pour les échanges bancaires et des fonctionnalités avancées de trésorerie, rapprochement bancaire et automatisation des flux (ERP et comptabilité).

Découvrir Exabanque

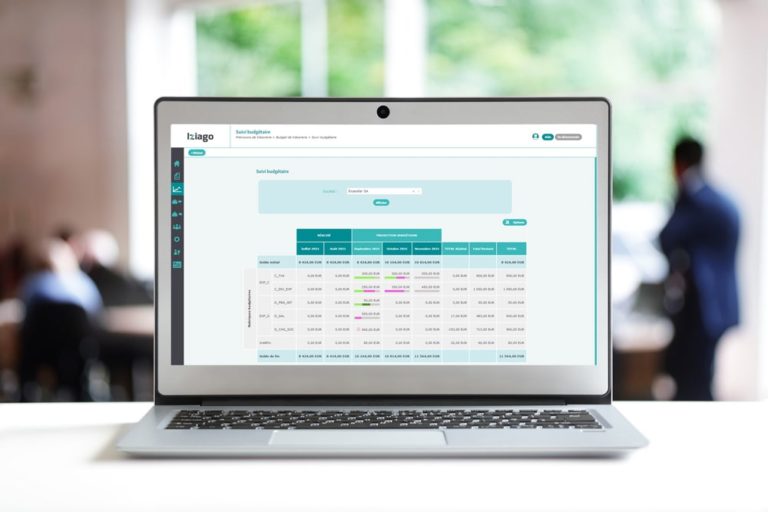

Solution complète de cash management pour les PME et TPE

Iziago propose aux PME une gestion complète de leur cash management grâce à sa solution modulaire : paiements et prélèvements SEPA et ISO 20022, prévisions et budgets de trésorerie, centralisation automatique des relevés bancaires, etc.

Découvrir Iziago

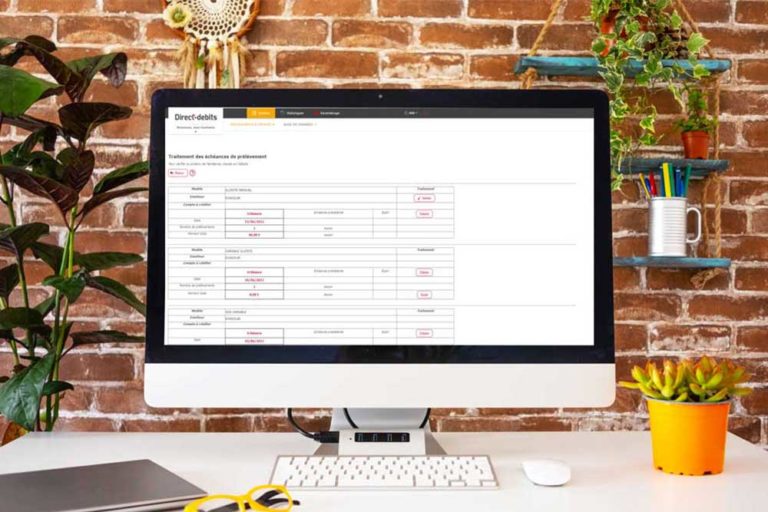

Gestion des prélèvements et mandats SEPA

Avec Direct-debits, vous gérez vos prélèvements et vos mandats au format SEPA : génération automatique des ordres, administration des échéanciers par abonné, création et stockage des mandats (électroniques), suivi et traitement simplifié des impayés, etc.

Découvrir Direct-debits

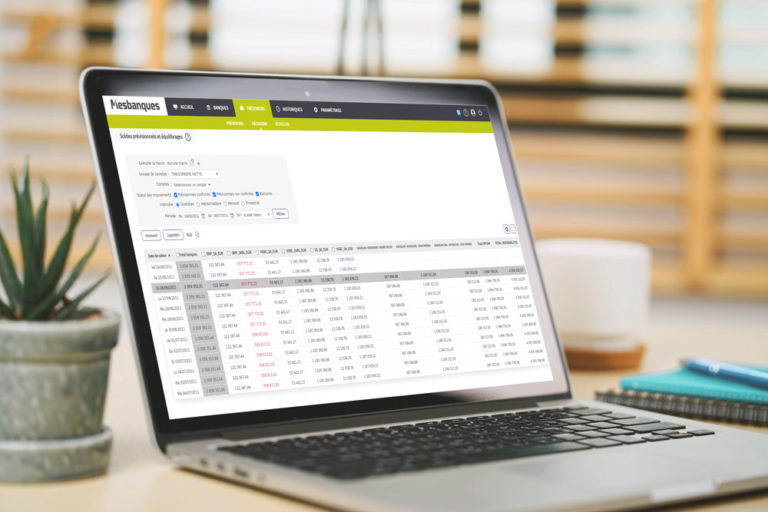

Solution multi-bancaire commercialisée par des distributeurs

Mesbanques est un logiciel web de gestion multi-bancaire commercialisé par un réseau de distributeurs en France et en Europe : communication bancaire en EBICS, trésorerie, rapprochement comptable, connexion avec des logiciels de gestion internes, etc.

Découvrir Mesbanques